Giving to the Endowment and the Legacy Society

The Legacy Society is dedicated to perpetuating the ministry and presence of the Unitarian Universalist Fellowship of San Dieguito by means of bequests, planned gifts, and outright contributions to the Fellowship’s permanent Endowment Fund.

- A lasting affirmation of how we feel about our wonderful Fellowship

- A tangible witness to the religious principles and purposes that guide our Fellowship’s mission

- A personal expression of faithful stewardship of those assets we have accumulated over a lifetime of hard work and good fortune

- An enduring legacy that ensures the continuing development of spiritual service, compassionate work, and social action in and beyond our community

Who Can Become a Member?

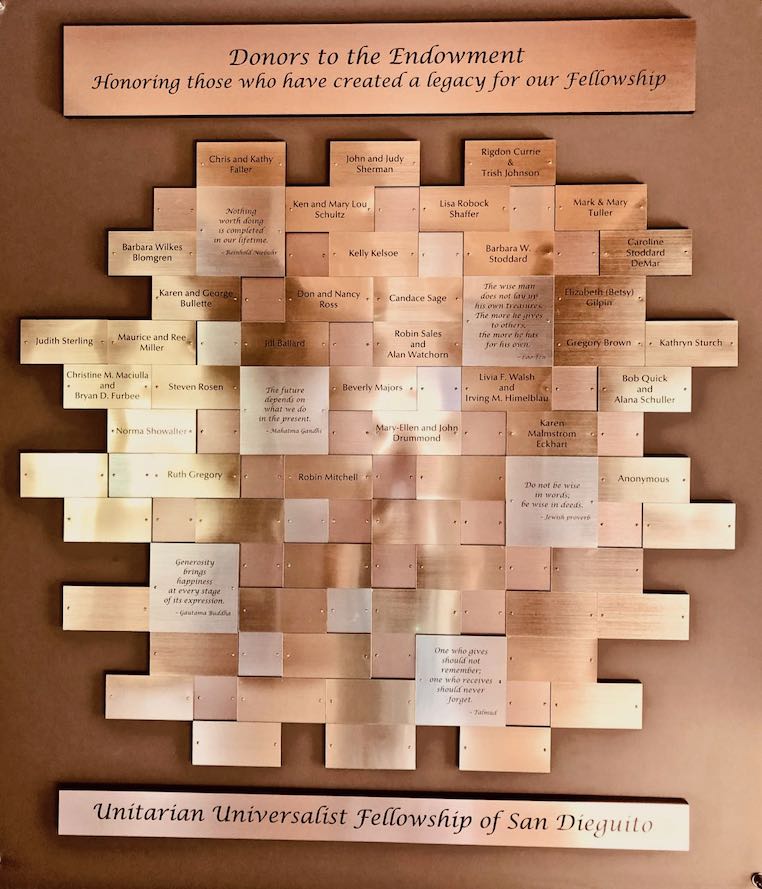

All members and friends of the Unitarian Universalist Fellowship of San Dieguito are eligible to join the Legacy Society by making a while-living gift to the Endowment Fund or by designating a future bequest or planned gift upon death. New members are recognized on the name plaque in the Library.

How Do I Join?

To join, print and complete the Notification of Planned Gift form, then give to one of the Endowment Committee members: Mark Tuller, Angie Knappenberger, Maria Moodie, or Alisa Guralnick. Alternatively, you may also mail your completed form to the UUFSD office to the attention of: Endowment Committee.

What Types of Gifts to the Fellowship Qualify for Membership?

A gift valued at least $1,000 makes the donor eligible for membership in the Legacy Society. Gifts may be:

- Bequests from wills and living trusts that name the Fellowship or its Endowment Fund as a beneficiary of your estate.

- Outright gifts of cash, securities (email treasurer@uufsd.org for help with securities), or tangible property designated for the Fellowship’s Endowment Fund. These gifts may include Gifts of beneficiary interest in an IRA or other pension plan, annuity, foundation, or trust, remainder gifts from a UUA Pooled Income Fund account, a UUA Charitable Gift Annuity, a charitable trust, or a life estate interest that benefit the Fellowship and can provide you with income for life and significant tax benefits.

- Gifts of paid-up life insurance policies or beneficiary interests in life insurance.

- Gifts of real estate.

- You may also make memorial gifts that benefit the Endowment Fund.

How Will the Fellowship Use My Contribution?

- If you designate your gift for the Endowment Fund, your gift will be added to gifts from those who have already given generously through the years to the Fellowship’s permanent Endowment Fund. The principal of your gift, invested in growth and interest-bearing assets, provides ongoing income critical to the Fellowship’s continuing ministry and mission. We recommend that you plan your giving in this manner.

- You may designate your endowment gift as unrestricted or as an endowment for the Building/Grounds Fund or for the Outreach/Service Fund or for the Music Program Fund. If you wish to designate your gift for a specific program or other special areas of interest, please consult with a member of the Endowment Committee before making your gift, to ascertain if the Fellowship will be able to carry out your exact wishes.

What Else Should I Keep in Mind?

- Members of the Fellowship’s Endowment Committee are available to help you learn about different gift options, but they are not qualified to give you legal or tax advice. Brochures are also available that provide helpful information about gifting. Always consult your legal and tax advisers before making a major charitable contribution.

- Please note: All correspondence with members of the Endowment Committee will be treated confidentially and with the utmost concern for your charitable interests. In addition, the gifting documents you provide will be kept by the minister in a confidential, locked cabinet in the minister’s office.

For more information, please contact the Endowment Committee at endowment@uufsd.org